Ashigher-education costs in the United States soars past $1.4T and continue to increase year over year faster than inflation across public and private 4-year institutions, startups continue to see huge opportunities in the education financing space. The now-dominant peer-to-peer / marketplace lenders and re-financers such as SoFi, Lending Club, Earnest, and Commonbond have matured in an environment where interest rates have been historically low, with business models that were said to offer high-quality, high-yield loans to investors. However, those served by these companies also tend to be more affluent, with higher credit scores — SoFi borrowers tend to have credit scores of around 730, with an average annual income of around $114,000.

Some companies claim to use alternative credit models to lend to underserved markets, but these also tend to be exclusionary, rather than inclusive, which I have written about before.

For context, the average 18–29 year old has a credit score of 652, increasing to 671 over the next decade; that said, credit scores tend to increase with age. As early-stage impact investors, we look for companies with innovative business models that are able to scale while helping as many low-income US individuals as possible engage with non-predatory lenders, and manage their student loan debt.

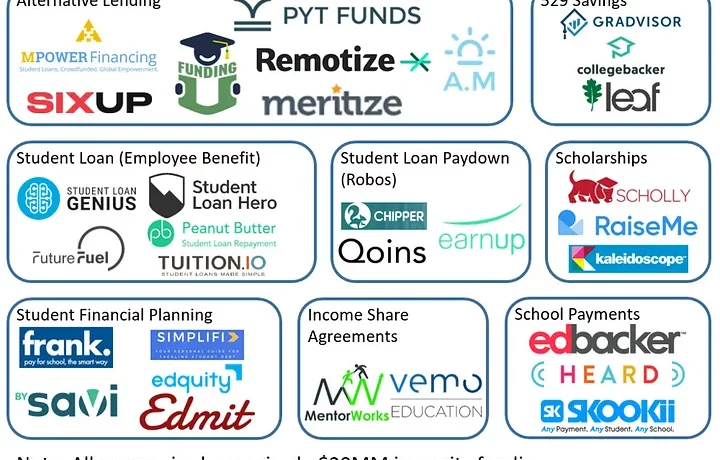

The graphic above shows how startups are tackling the higher-education financing problems from a number of areas. The different kinds of companies sit across a number of interesting intersections, some enjoying significant funding while others are not. What follows is a survey of a few different sectors, which broadly include:

- B2B employee-retention startups targeting student loans

- Consumer-focused startups offering tech-enabled savings

- Startups using, or creating, alternative credit models to increase access to credit

- Other models, including platforms increasing transparency to private and public scholarships

Student Loan Matching by Employers

This space has seen many entrants in the last few years as founders saw an opportunity to scale what employers had been doing on an ad hoc basis before. There has already been some liquidity, as seen with Gradifi’s exit to First Republic Bank, but the space is still early, with a focus on scaling assets under management and finding sources of capital to match the enormous debt burden the students at the enterprises have. This B2B approach fits neatly within the ongoing focus on retaining and recruiting both millennials and diverse talent in the workforce.

A recent Kapor Center “Tech Leavers” study estimated that the annual cost of turnover for diverse talent in tech alone was worth $16B, and other surveys estimate that replacing a new worker costs vary, from 100–213% the cost of one year’s salary

The employer is betting the matched interest payments will be a small price to pay to retain them, especially as college costs continue to rise. We invested in Student Loan Genius in this sub-sector, and have seen the great potential and challenges in scaling these kinds of companies.

Education Robo-advisors

For the last few years, taking off around 2014, consumer-focused fintech saw an increase in automated investing, saving, and money management apps, or “robo-advisors” (or, “robos”) that attracted users due to their low fees and ease of use. Notable robos include Acorns, Personal Capital, and Digit. The popularity of these products led to a huge growth in venture funding for the sector and assets under management (“AUM”) for the startups. Per S&P Global’s calculations for a cohort of notable robos, AUM reached $7.5B in 2015, compared to only $0.7B in 2012.

The education finance space has seen a number of robos take advantage of this trend, both for paying down student loan debt and saving for college via 529 college savings plans. However, the huge number of competitors and clear segment winners has seen funding dry up for robos at the very early stages barring explosive growth or interest, especially with a transaction, AUM-based business model. We are investors in EarnUp, whose loan paydown solution, through collaborations and an inclusive product, has great potential to scale significantly, and has already helps Americans manage over $1B in loans.

With the recent passage of the Tax Cuts and Jobs Act there is a great opportunity for a 529 college savings plan company to grow given their recently expanded potential uses. Wealthfront’s built-in 529 offering could make it difficult for these kind of startups to compete, but consumer fintech platforms could use these startups as a way to increase a user’s engagement and LTV on a platform given the novelty of the product. There are also opportunities to expand the 529s’ use for all income brackets, as it is currently mainly used by higher income-earners.

Alternative Credit Startups

The alternative credit segment is growing as fintechs see the huge potential “thin credit” and otherwise “unscorable” populations, or populations that have a poor credit due to a lack of previous credit but that offer otherwise non-risky credit future behaviors. These are mostly millennials, but are also immigrants with high promise of success in undergrad and graduate school.

Rather than just focusing on MBAs or MDs, we feel that reaching high-potential domestic students who may not have access to traditional credit offers a large and interesting market, if scaled properly.

Top of mind here are students without access to a co-signer for a loan, undocumented students, and DACA recipients, undocumented students who were given a two-year “deferred action” from deportation.

One of the leaders, MPOWER Financing, offers student loans to international and domestic students using a proprietary credit scoring system, and in late 2017 announced that they had a $300MM pipeline of loan applications while serving all 50 states. While direct lending, as a sector, is also a difficult one to scale in given the difficulty in raising debt capital, the race to reach $1B in originations quickly, and expectations of nominal default rates, advances in data science create the potential, and hope, for non-FICO-based credit models to expand the market for those who need it most, in a non-predatory fashion.

Other Models

There are other interesting business models we have seen in this space, including micro-scholarships and financial education / school comparison startups trying to inform and provide products to students. Income share agreements can provide an interesting alternative-financing model to students, but it may take a movement to get enough students (and schools) to believe in this model to make it truly scale. Collections and a large number of partnerships to ensure the startups get paid for training / placing students are some concerns in this space. One of our portfolio companies, MakeSchool, has structured an income share agreement to support their students getting an alternative to a four-year CS degree, which we believe has a lot of potential to scale and has already proven very successful in training students and placing them.

Finding ways to engage community colleges and technical schools in financing also provides an interesting opportunity as employers continue to ask for more education from their workers.

There are many opportunities for innovation in this space, including in blockchain, as smart funding grows and startups expand outside of speculative cryptocurrency to tackle real problems. For example, the blockchain could be used to incentivize students with microscholarships via smart contracts that execute upon getting certain grades, seeded through sponsoring entities or schools. Or, credit information could be stored on the blockchain so individuals traveling immigrating around the world would have their credit information with them, and not get to the US without a score, and fall prey to predatory interest rates or lack access to credit.

Outside of the still-very-early blockchain space, with edtech funding increasing along with fintech funding growing, this space is poised to continue expanding in terms of entrants and business models, hopefully serving those who need help the most. If you are working on an idea that you think can scale and grow, reach out to jorge [at] kaporcapital [dot] com to share what you are building and see if we can work together to help it grow.