Back in January, we posed the question, Can Women Save VC? The tl;dr answer: maybe, but not if our focus is solely on increasing the numbers of women who share backgrounds, credentials and viewpoints with their male counterparts currently sitting atop an already dysfunctional Venture Capital system.

As currently practiced, venture capital:

- Measures its success ultimately in terms of financial outcomes, rarely accounting for the good — or the harm — done, thereby often widening gaps between haves and have-nots and taking no responsibility for increasing income inequality, and the myriad disparities in educational and health outcomes by the overlapping categories of race, gender and socioeconomic status;

- Funds a narrow range of entrepreneurs and fails to take advantage of the broad swath of entrepreneurial talent from diverse backgrounds;,

- Over-invests capital to fund hyper-growth, which is very often not in the best interest of founders, their companies, or the customers they serve.

A Better Way

Earlier this month, Kapor Capital released our first-ever Impact Report, making public our financial returns and mapping out our vision for a newer, better model of Venture Capital. Our focus has gap-closing at its core.

For the last eight years, we’ve engaged in an experiment, investing exclusively in “impact” startups, companies committed to closing the gaps of access, opportunity, and outcomes for low-income communities and communities of color in the United States.

When we made that shift, we made a gamble. Other VCs cautioned that investing exclusively for impact would necessarily come at the sacrifice of financial returns, and to be honest, we were not completely sure ourselves if our model would hold. But we did start off with a variety of assumptions:

- Every business creates an impact of some sort — some positive, some neutral and some negative.

- Many technologies that widen the gaps in society can be transformed into gap-closing companies with the right business model.

- Genius is evenly distributed throughout society, regardless of race, gender or zip code — but opportunity is not.

- The lived experiences of underrepresented entrepreneurs provide a competitive edge in identifying problems to be solved and markets to be accessed.

- Silicon Valley’s pernicious myth of “meritocracy” actively exacerbates the problem of who gets to identify problems and come up with tech-enabled solutions.

- “Distance traveled,” the measure of how far an entrepreneur has come and the obstacles they overcame on their path to Silicon Valley, is a far better predictor of long-term success than proxies like schools attended or investments raised from friends and family.

- Diversity at the investment decision-making table is key to deal flow from underrepresented entrepreneurs; a majority of underrepresented women and men of color form Kapor Capital’s investment team and lead to a growing network of talent including entrepreneurs, co-investors and those who want to be part of a gap-closing tech ecosystem.

- Financial returns cannot be the only measure of a company’s success. We aim to disrupt the very way that businesses are evaluated. “Impact” investing shouldn’t be the outlier; greed-first investing should be the category getting scrutinized.

These assumptions — values, really — form the basis of our notion of VC 2.0.

We want to fundamentally disrupt the way that tech startups are evaluated — and build the right teams to get us there.

Regina Escamilla, Freada Kapor Klein, Mitch Kapor, Lisa Molinaro, Eduardo Laiter, Fatima Loeliger, Carolina Huaranca, and Ulili Onovakpuri

If companies were required to calculate their impacts — good jobs with living wages and benefits created or lost, pollutants pumped into the local community, air or water, shoring up or tearing down democracy — we’d see a different kind of Silicon Valley, one that lives up to its promise to change the world for the better.

PS: It Works!

After 8 years of testing our assumptions, we’re proud to say that our hypothesis holds up nicely.

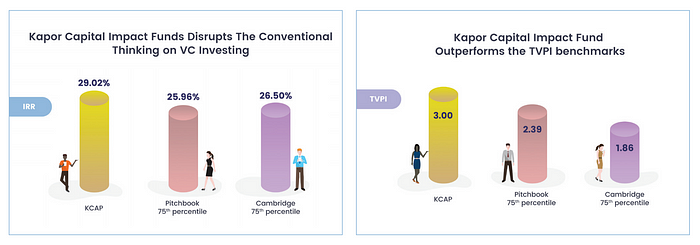

For the purposes of our Impact Report, we looked at two of the most important indicators of the financial performance of portfolio:

- Internal Rate of Return (IRR)

- The Total Value to Paid In (TVPI) Multiple

Happily, we can say that by both measures, Kapor Capital’s Impact Portfolio ranks in the top quartile of venture funds of comparable size:

But even more importantly, we are excited to show the specific impacts that our companies are making in the world: closing gaps in education inequality, helping families access healthy foods, disrupting predatory lenders, improving the lives of incarcerated citizens, creating technical jobs in “underdog” communities, helping people access quality health care, reducing carbon emissions in inner cities and so much more.

VC 2.0 means a real values alignment between investors and entrepreneurs by inviting new and different people to join the table or sit side-by-side at a brand new table. We want to encourage varied and diverse entrepreneurs to pitch more gap-closing businesses.

We need to help entrepreneurs navigate when it is — and isn’t — in their best interests to raise as much money as possible; on why raising at too high a valuation may hurt them long-term; helping them keep their ownership of their companies as long as possible.

We need more impact investors to step up, especially at the Series A and B stages.

We need Limited Partners (LPs) to step up and hold VC firms accountable. Some of the largest LPs are stewards of endowments held by universities, foundations and pension funds of public employees. It’s time they invest consistently with the missions of those institutions. We hear a resounding chorus of interest in wanting to build gap-closing businesses and to invest in them, but too often there is pushback. The prevailing mythology of focusing just on financial returns and ignoring the real human and financial costs of pursuing that strategy should be left behind.

Let’s not be afraid to call out greed and its destructive consequences.

Let’s all be more clear about who we are, and who we aren’t.

The numbers are clear: We no longer need to heed the naysayers who told us it can’t be done.